- Tax avoidance is a hot topic at the moment. A look at which companies avoid the most.

- Also, why are we keener to boycott Starbucks than Amazon or Google? Is it because Starbucks in on the high street and online choices we keep to ourselves?

Portugal in Crisis

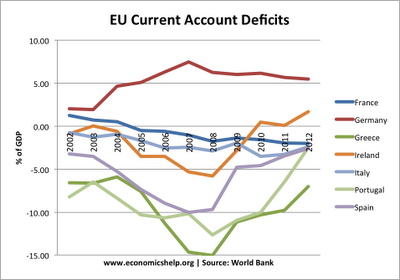

Readers Question: Can you tell what Portugal has done to reduce the Current Account as % GDP deficit so steeply?The reduction in the Portuguese deficit is quite striking. From what I can gather, essentially, the rapid reduction in the current account is due to a sharp fall in consumer spending on imports, combined with some growth in exports – helped by improvements in unit labour costs. But, the Portuguese economy remains deeply depressed.

see also: Portugal Economic crisis

EU Competitiveness

In the lead up to the Euro debt crisis, there was a marked divergence in competitiveness within the Eurozone. In fact, some economists suggested that the currency imbalances were the root cause of the Eurozone fiscal crisis. However, recent evidence suggests some restoration of competitiveness within the Eurozone. See: the extent of EU competitiveness improvements

How Important are Credit Ratings?

Do you remember all those sub-prime mortgage bundles which caused the credit crisis? These mortgage bundles which later proved to be almost worthless were, for a considerable period, given a AAA credit rating by rating agencies. Even Greece, now on the verge of insolvency, maintained an A credit rating until May 2009. ( What did a credit rating of A mean for Greece? It meant the credit rating agencies didn’t really know what was coming quite soon. (nor the rest of the market either)Because credit ratings are a highly visible signal, they can perhaps gain more political importance than they perhaps deserve. A triple AAA credit rating sounds good. (Plus, it’s much easier to explain to the public than the ‘merits of expansionary fiscal policy in a liquidity trap’.)

- more on should we worry about losing our AAA credit rating?

The Decline of the Coal Industry

An essay looking at the long decline of the UK coal industry.

Graph of the Week

Triple dip recession in UK likely. OBR budget deficit forecasts make grim reading too.

Reasons for US Budget Deficit

A look at why the US deficit is so large. Spot the recession.

Quick Links

- How valuable is the Oxbridge interview process?

- In 16 developed economies, labour took a 75% share of national income in the mid-1970s, but this has dropped to 65% in 2007. Why wages are declining as a share of national income - and what it means.