1. Relative Inflation

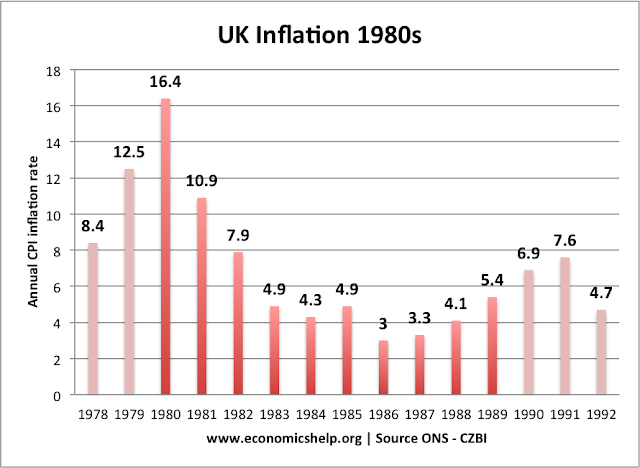

If the inflation rate is relatively lower than in other countries, then over time you become more competitive because your goods will be increasing at a slower rate. For example, in the post-war period, Japan and Germany had relatively lower inflation rates than major competitors, this helped them to become more competitive.

2. Productivity

Productivity is a measure of output per input. The most common measure would be labour productivity. For example, with improved technology and education, a country can enjoy higher labour productivity and therefore produce goods at a lower cost. Higher labour productivity is the key to increasing competitiveness and living standards at the same time.

German vs Italian labour productivity. During this period, Italian labour productivity growth has tended to lag behind Germany, leading to lower competitiveness of Italian exports.

3. Exchange Rate

Movements in the exchange rate will determine competitiveness. For example, a sharp depreciation will make exports cheaper and more competitive. An increase (appreciation) in the exchange rate, makes the foreign currency price more expensive.

Often movements in the exchange rate reflect relative costs. For example, if a country has lower inflation, this will lead to an appreciation in the exchange rate, making exports relatively more expensive. Thus a floating exchange rate helps to maintain relative competitiveness levels.

However, sometimes economies can artificially maintain a lower value of the exchange rate to maintain competitiveness. For example, China has been accused of exchange rate manipulation. China buys large quantities of US securities, this causes an increase in the value of the dollar and helps to keep the Yuan undervalued. Therefore, this helps Chinese exports to be more competitive and explains the large Chinese current account surplus

Government has used supply-side policies to increase productivity. E.g. education and training.

However, there is a limit to what the government can do to increase productivity. Increased productivity can be due to other factors.

Competitiveness in the Euro

In the Euro, countries have a permanently fixed exchange rate - they cannot devalue to restore competitiveness. Therefore divergences in labour costs and productivity will have a bigger impact on competitiveness than in a floating exchange rate.

.

4. Tax Rates

Tax rates on labour and corporations will be a factor in determining competitiveness. For example, higher labour taxes will increase the unit cost of labour faced by firms, leading to lower competitiveness.

5. Cost of Doing Business

It is argued that countries with more labour market regulations, and regulations about doing business will have higher costs and lower competitiveness. For example, the difficulty in gaining planning regulations to expand a factory.

The World Bank produces a list of countries which are the 'easiest places to do business'. The criteria include factors such as flexibility of labour markets, degree of regulations, protection of private property.

Top 10 ease of doing business

- Singapore

- Hong Kong

- New Zealand

- United States

- Denmark

- Norway

- United Kingdom

- South Korea

- Iceland

- Ireland

6. Infrastructure

A key factor in determining competitiveness is the cost of transport. For example, some argue the UK's competitiveness is undermined by bottlenecks in transport, such as limited airport capacity in London and traffic jams on major roads.

7. Tariffs and non-tariff barriers

A key factor is the cost of tariffs and non-tariff barriers. For example, after the UK leaves the Single market, if it has regulatory divergence, then British business may have higher costs as a result of differing standards.

Related