The 1970s was not just an era of dayglow trousers, lava lamps and the emergence of punk rock. It was a traumatic economic decade of stagflation, a three day week and the return of unemployment. Yet, despite some headline-grabbing crisis - it was also a decade of rising living standards, the growth of credit and rising property prices.

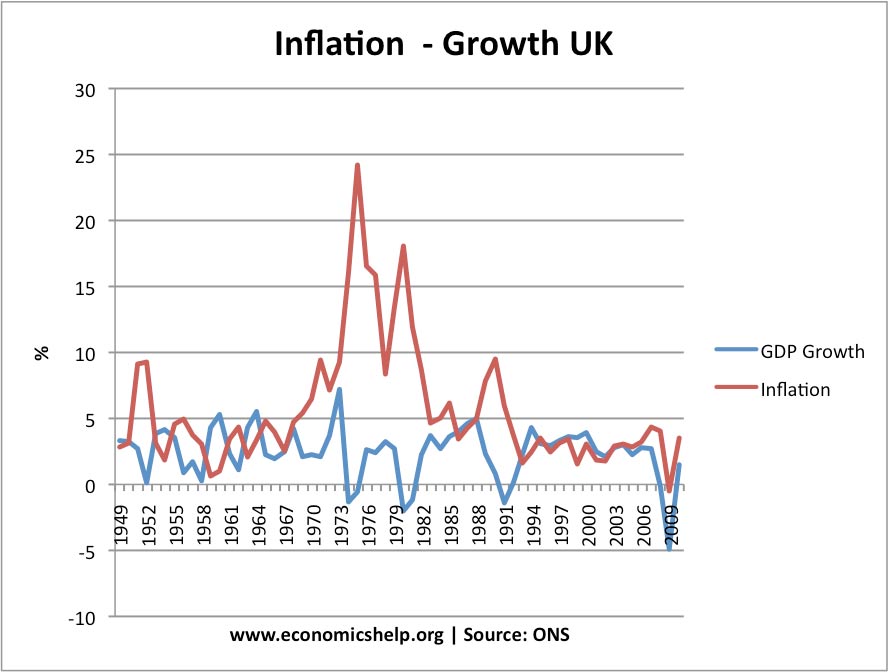

Graph showing combination of high inflation and volatile output.

Barber Boom 1970-73

The early years of the 1970s were a period of rapid economic growth.- The Bank of England deregulated the mortgage market - meaning High Street Banks could now lend mortgages (not just local building societies). This helped fuel a rise in house prices and consumer wealth.

- Barber Boom of 1972. In the 1972 budget, the chancellor Anthony Barber made a dash for growth - with large tax cuts against a backdrop of high economic growth.

- Growth of Credit. It was in the 1970s, we saw the first mass use of credit cards (Access). This helped create a consumer bubble.

Inflation Crisis

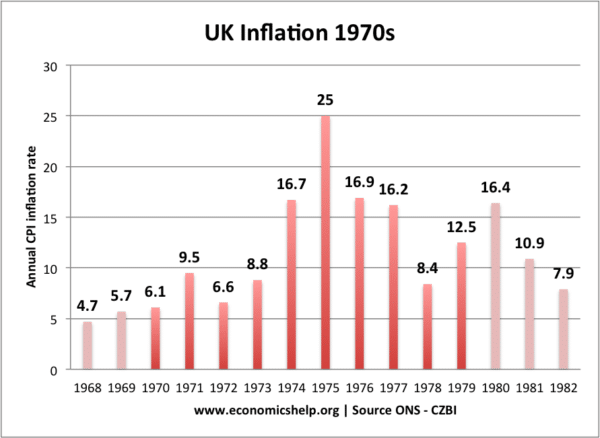

By 1973, inflation in the UK was accelerating to over 20%. This was due to:

- Rising wages, partly due to strength of unions.

- The inflationary budget of 1972.

- Growth in credit and consumer spending.

- Oil price shock of 1973, leading to 70% increase in oil prices.

Trying to deal with inflation

Belatedly, the government tried to deal with unemployment, through higher interest rates. Also, the Heath government tried capping wages. This was fuel for industrial unrest, leading to frequent and widespread strikes. In 1973, the miners went on strike and were also joined by sympathetic trades unionists - led by, amongst others, the young and infectiously strident Arthur Scargill. Growing up in Thatcher's Britain, it is hard to remember how powerful trades unions actually were at the time. During Heath's government 9 million working days were lost to strike action - plus more to practises such as 'working to rule'. Flying pickets successfully blocked coal and coke factories, which at the time produced the majority of the nation's power. Suddenly the life source of Britain's energy was being blocked. At the height of the strike, Britain was on a 3 day week, with the Prime Minister, Edward Heath making public appeals to conserve energy.1974, also saw an unwelcome return of a real recession. This recession was caused by the end of the Barber boom and falling living standards from rising prices. In the post-war period, we had booms and busts, but, the bust were relatively mild, with only very minor declines in output. But, in 1974, output fell 3.4% causing a return of high unemployment not seen since the 1930s.

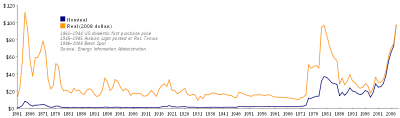

Oil Prices in the 1970s

- blue line - nominal oil prices

- Yellow line - Real oil prices, adjusted for inflation

Since oil had become an intrinsic part of the economy, we had taken it for granted that oil could be bought cheaply. The 1960s and early 1970s, saw a rapid rise in ownership of cars and motoring. Britain enthusiastically embraced the motor car - helped by rising incomes and cheap petrol.

But, the 1973 oil crisis, changed all that. Suddenly the price of petrol more than doubled and the UK faced an energy crisis to go along with a spike in inflation. The government seemed powerless as Britain was put on a three day week and TV was turned off at 10.30pm. Emergency speed limits were introduced to conserve petrol.

If in 1957, we had never had it so good, by 1973, it seemed we had never had it so bad. It was a return to the 1940s austerity; but with no obvious enemy, the public were less forgiving of this inconvenience.

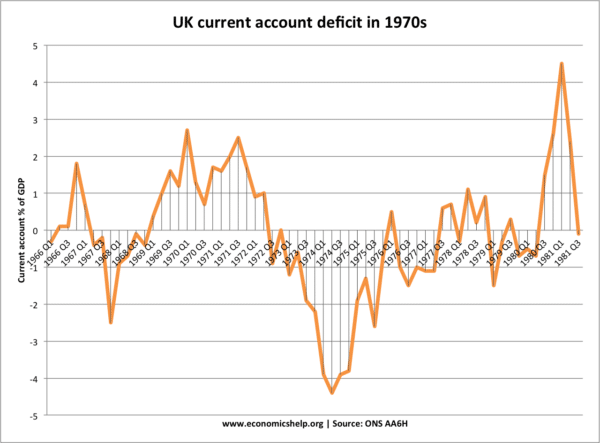

UK current account

In the mid 1970s, the UK saw a deterioration in the current account. High UK inflation was making UK goods less competitive. Also domestic consumer spending remained relatively strong - sucking in more imports. Although the current account reached a peak of only 4% of GDP in late 1974, (low compared to current account in 2000s) there were greater concerns about financing the current account deficit in the 1970s due to less investment income

1976 IMF Bailout

In 1976, the UK needed to apply to the IMF for a bailout. This was due to high budget deficit and also concerns over the value of Sterling. Markets believed Sterling was overvalued and so kept selling. This caused the Pound to depreciate.Britain asked the IMF for a £2.3bn bail out in 1976 saying unemployment and inflation were at exceptional levels.

In return the IMF insisted on deep spending cuts to tackle the budget deficit. The government implemented spending cuts. By 1977, the economy showed signs of recovery, and helped by oil revenues the balance of payments improved. The pound also strengthened after the loan. The UK did not need to draw-out the full loan. More detail at: IMF crisis

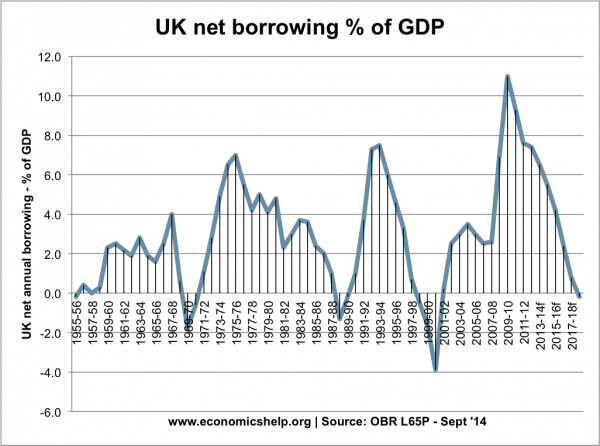

UK borrowing in the 1970s

From UK Budget deficit

UK budget deficit rose rapidly from 1971/72 to 1975/76

Due to rise in GDP, total public sector debt fell from approx 60% of GDP (1970) to 50% in 1980 (see: National debt

The Winter of Discontent

In the late 1970s, inflation had continued to be a problem; with a combination of rising oil prices and rising nominal wages. Again the government sought to control the wage inflation by imposing wage caps. But, again the unions were in no mood for stiff wage settlements. Strike action broke out across the country, extending from the industrial heartlands to the public sector. Public servants from dustbin men to gravediggers in Liverpool went on strike. Unburied coffins in Liverpool piled up, and in cities across the UK, garbage went uncollected. Not for nothing, was that period of strike action called the 'Winter of Discontent'. It seemed the government was unable to control either inflation or the strike action. A feeling of powerlessness pervaded the country.In some regards, the economic situation of the 1970s was not quite as bad as the dramatic Winter of Discontent suggested. Certainly, the three day week was a radical event. But, it was relatively short lived. The 1970s was a period of rising living standards. Nor is the 1970s a vindication of monetarism and proof of the failure of Keynesianism. See: How Really bad was the 1970s?

Yet, the UK economy had fundamental problems, and it needed a radical shake up. But, no-one could have predicted quite how radical the Thatcher revolution would be... (to be continued - see: economy of 1980s)

Housing Market in 1970s

The 1970s was a period of rapid house price growth, especially in the early 1970s.During the 1970s, home ownership rates increased from 51%, 1970 to 57% in 1981

In 1970 Q1, average house prices were £4,377

By 1973 Q1, average house prices had more than doubled to £8,395

Real house prices rose in the early 1970s because:

- Rise in incomes

- MIRAS - tax relief on mortgages, encouraged people to get a mortgage.

- Deregulation of mortgage sector

- Greater aspiration to own a home

|

unadjusted for inflation. Nominal house pricesReal House |

| |||

| Real house prices adjusted for inflation, stayed constant in second half of 1970s. |

|

| Annual % growth in house prices. |

7 comments:

I LOVE THIS ARTICLE!!:)

Great article makes a dry subject like economics acesable and intresting to the lay man

Thats a nice aticle. Could you send me a link where you got the data from ons? I couldn't find them

Thanks a lot in advance!

Really nice article.

However I wasn't able to find the data on the ONS website. Could you send a link where to find that?

Thanks in adavance!

House prices started to rise after the Tory Party abandoned Schedule A Tax in 1963, which taxed the increased values of LAND. It took the tax directly out of income tax.

Now, gains from land were tax free. Money poured into unproductive land and not into productive enterprise activities. House prices rose. Also coupled with the Stalinist T&C planning act an artificial land shortage was created. Prices went even higher.

Tory chancellor Barber in 1970/71 making credit easier to buy homes (LAND), again encouraged money to pour into unproductive activities - LAND.

Income inequality greater than productive inequality is an artefact of privilege, of which landowner privilege is certainly the biggest and probably the most

economically harmful. An increasing concentration of wealth and/or income indicates that privilege is in the ascendant over production, and rent seeking from land commensurately more profitable than the productive labour and capital goods investment that produce economic growth.

As rent seeking (in unearned gains from land & its resources in rent seeking or windfall land gains) squeezes out production, especially productive investment, the whole economy is made poorer. Most people have no idea that there is a difference between productive investment and rent seeking.

A simple tax shift can redirect money into productive economic growth investment, not harmful tax free rent. That tax shift is Land Valuation Taxation coupled with no Income tax.

Harmful land speculation is curtailed and production is rewarded by no Income and Sales taxes.

There is a comment in the article as follows; "Belatedly, the government tried to deal with unemployment, through higher interest rates"

Increasing interest rates will increase unemployment. Can someone explain?

Very useful, thanks. I write political articles on my own blog and I'd like to use one or two of your articles as references if that's ok. :)

Post a Comment