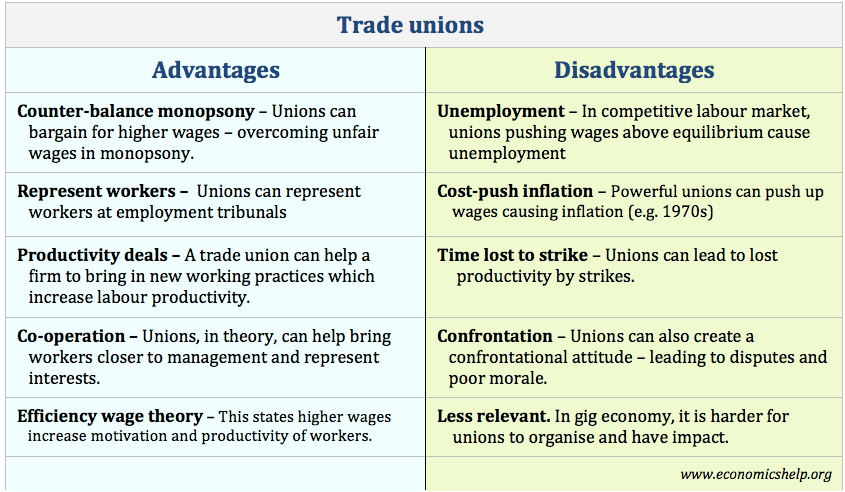

Trade unions are organisations representing the interests of workers. They were formed to counter-balance the monopsony power of employers and seek higher wages, better working conditions and a fairer share of the company's profits.

Critics of trade unions argue they can be disruptive to firms, discouraging investment and improved working practices. Furthermore, powerful unions can lead to macroeconomic problems such as wage inflation and lost productivity due to strike action.

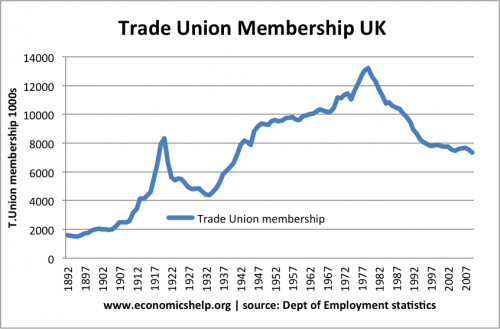

In the post-war period, trade unions gained substantial power and had a large influence over wages, unemployment and the economy. However, with the decline of manufacturing industries, unions have gone into decline and some economists argue this has contributed towards increased wage inequality.

This is a look at the main pros and cons of trade unions in the modern economy.

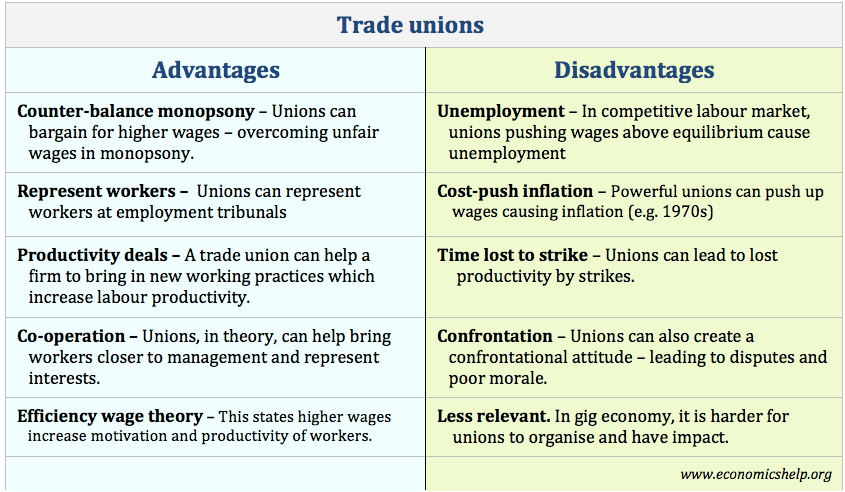

Advantages of Trades Unions

1. Increase wages for its members

Industries with trade unions tend to have higher wages than non-unionised industries. Trade unions can pursue collective bargaining giving workers a greater influence in negotiating a fairer pay settlement.

The

efficiency wage theory states that higher wages can also lead to increased productivity. If workers feel they are getting a higher wage, they can feel more loyalty towards the firm and seek to work for its success.

2. Counterbalance Monopsony Power

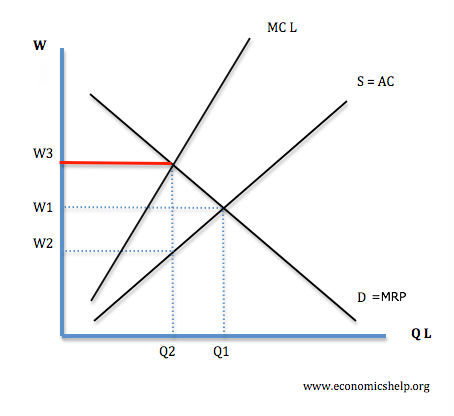

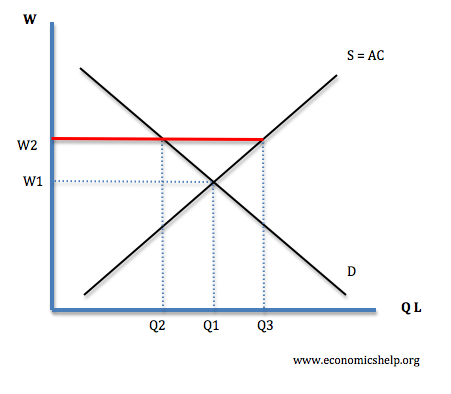

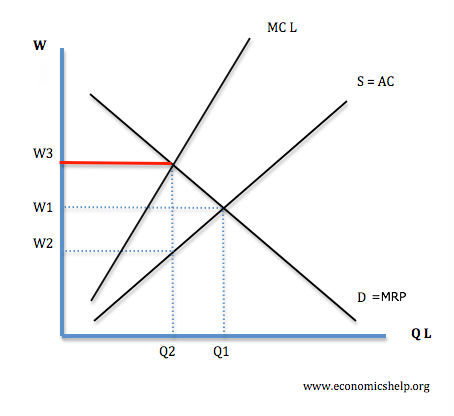

In many industries, firms have a degree of monopsony power. This means firms have market power in employing workers. It enables firms to pay wages below a competitive equilibrium (W2) and also employ fewer workers at Q2. There are many cases of powerful firms making a very high level of profit, but paying relatively low wages.

If firms have monopsony power, then a trade union can increase wages without causing unemployment. Even if a trade union successfully bargained for a wage of W3 - employment stays the same as Q2. If a trade union bargains for W3, it does not create unemployment, but employment stays at Q2.

In the face of monopsony employers, trades unions can increase wages and increase employment. Traditionally, monopsonies occur when there is only firm in a town or type of employment. However, in modern economies, many employers have a degree of monopsony power - related to difficulties of moving between jobs.

3. Represent workers

Trades Unions can also protect workers from exploitation, and help to uphold health and safety legislation. Trades unions can give representation to workers facing legal action or unfair dismissal.

4. Productivity deals

Trades unions can help to negotiate and implement new working practices which help to increase productivity. For example, in wage negotiations, firms may agree to increase pay, on the condition of implementing new practices, which lead to higher productivity. If the trade union is on board, then they can help create good working relationships between the owners and workers.

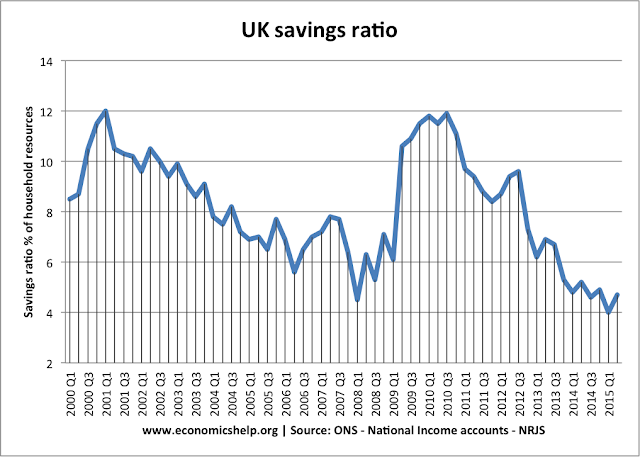

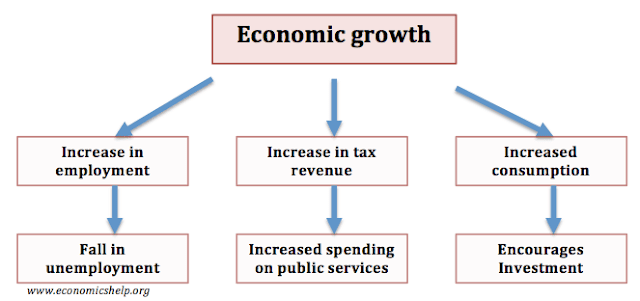

5. Poor wage growth in non-unionised workforce

Modern labour markets are increasingly flexible with weaker trade unions. These new developments in labour markets have led to a rise in job insecurity, low-wage growth and the rise of zero-hour contracts. Non-unionised labour helps firms be more profitable, but wages as a share of GDP has declined since 2007. Unions could help redress the monopoly power of modern multinationals.

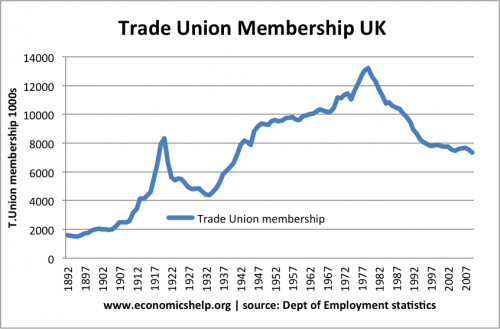

In 2011 there were 6,135,126 members in TUC-affiliated unions, down from a peak of 12,172,508 in 1980. Trade union density was 14.1% in the private sector and 56.5% in the public sector.

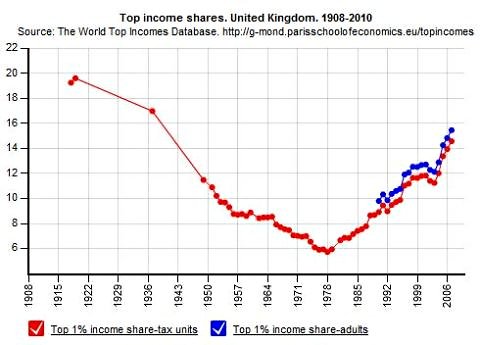

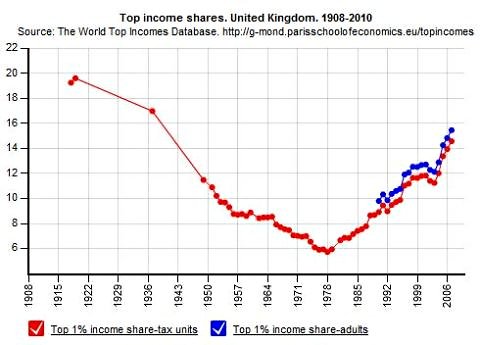

6. Reduce inequality

From the late 1890s to 1980s, the UK saw a growth in trade union membership. This was also a period of falling inequality and a reduction in relative poverty. Since trade union membership peaked in the early 1980s, this trend of reduced inequality has been reversed and inequality has increased.

Potential disadvantage of Trades Unions

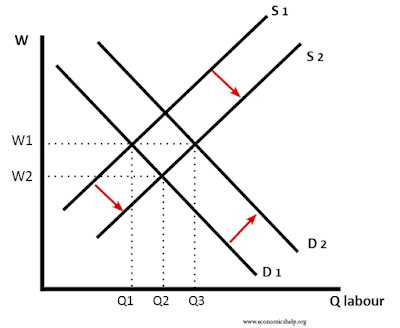

1. Create Unemployment

If labour markets are competitive, and trade unions are successful in pushing for higher wages, it can cause disequilibrium unemployment (real wage unemployment of Q3-Q2). Union members can benefit from higher wages, but outside the union, there will be higher unemployment.

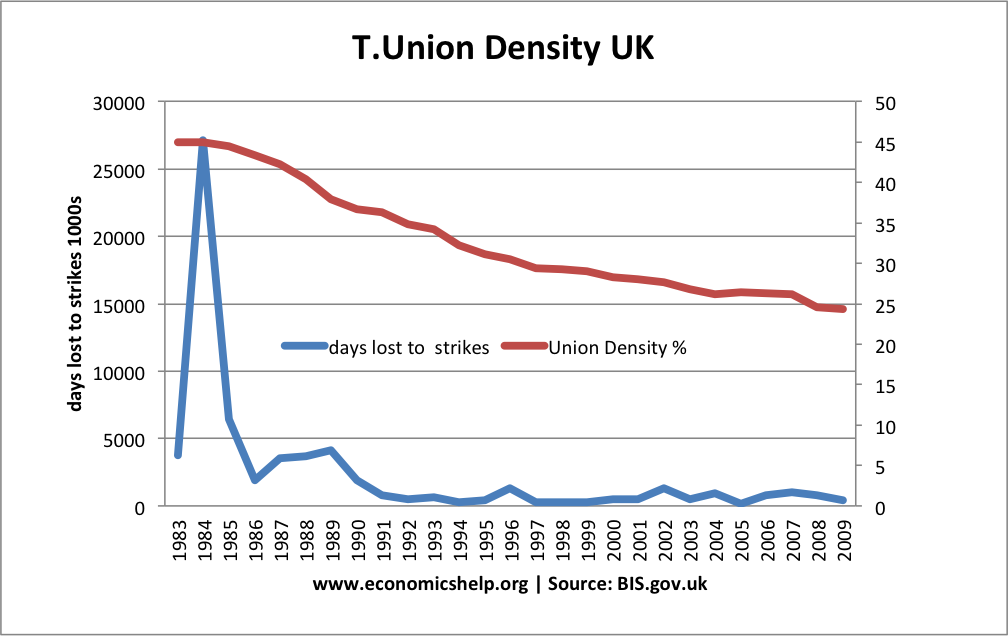

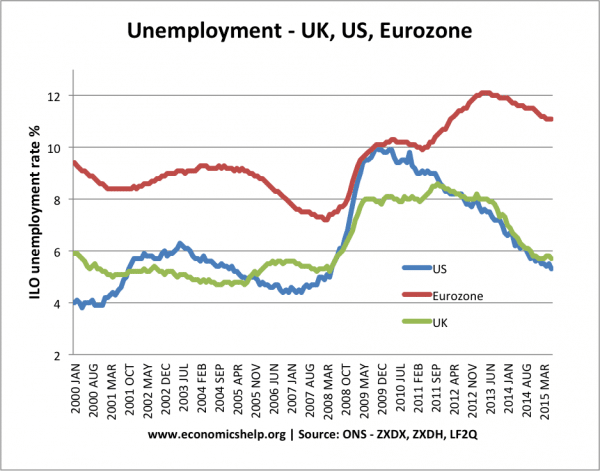

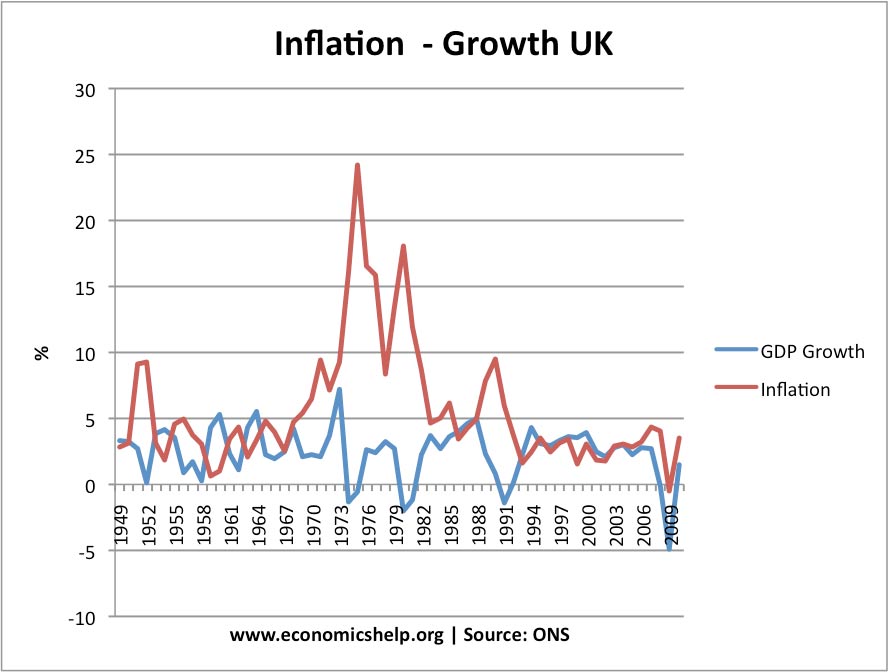

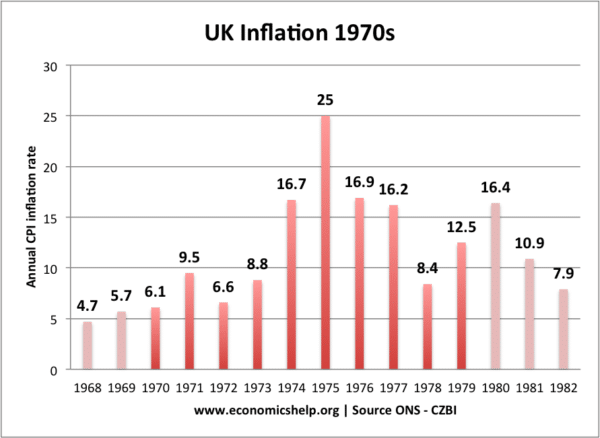

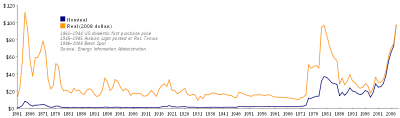

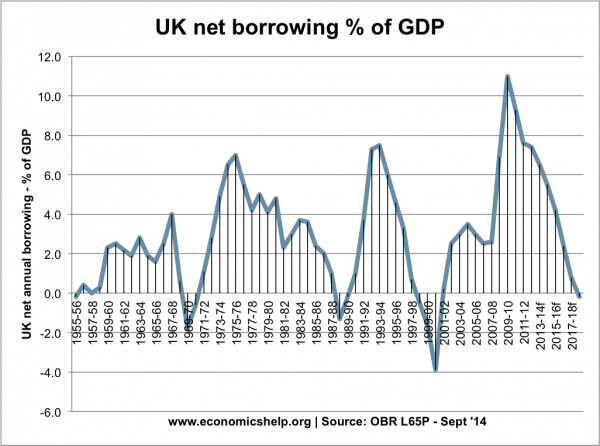

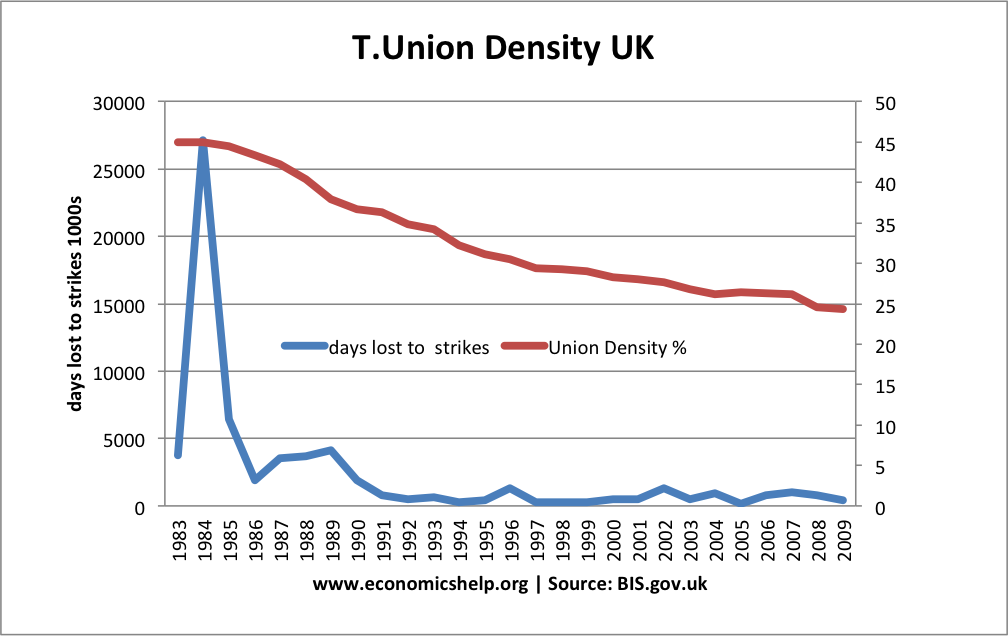

It is also argued that if unions are very powerful and disruptive, it can discourage firms from investing and creating employment in the jobs. If firms fear frequent strikes and a non-cooperative union, they may prefer to invest in another country with better labour relations. For example, in the 1970s, the UK experienced widespread industrial unrest and this is cited as a factor behind the UK's relative decline.

2. Ignore non-members

Trades unions only consider the needs of its members, they often ignore the plight of those excluded from the labour markets, e.g. the unemployed.

3. Lost Productivity

If unions go on strike and work unproductively (work to rule) it can lead to lost sales and output. Therefore their company may go out of business and be unable to employ workers at all. In many industries, trade unions have created a situation of a confrontational approach.

Decline in trade union density has led to a decline in days lost to strikes.

4. Wage-inflation

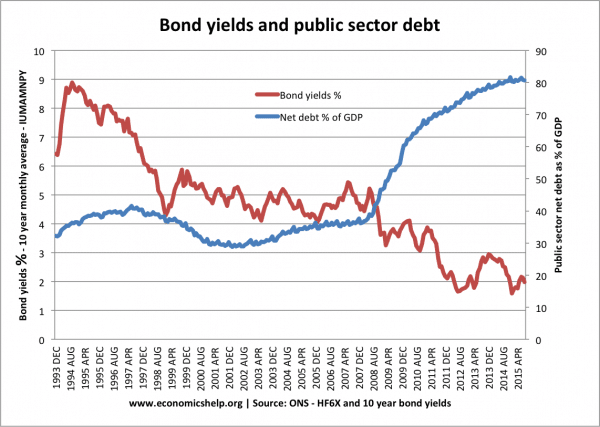

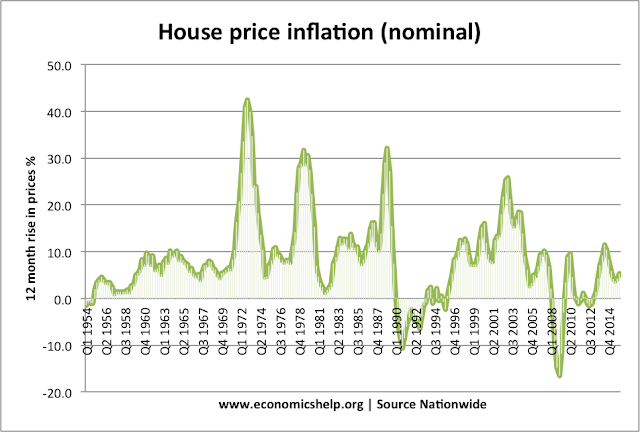

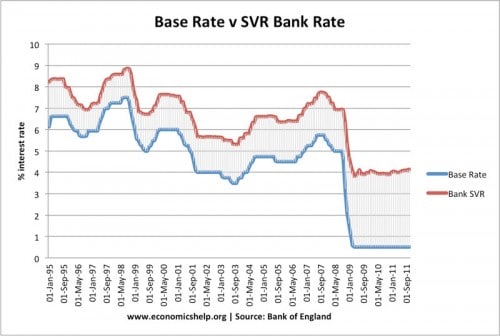

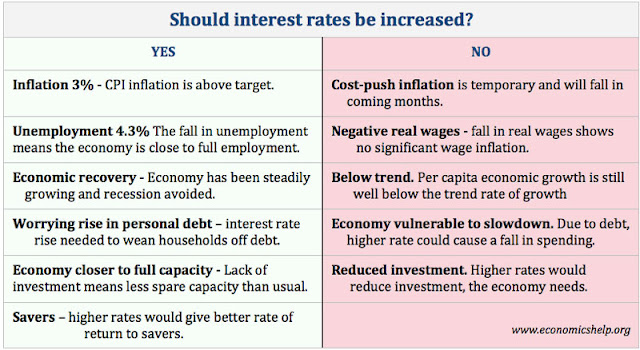

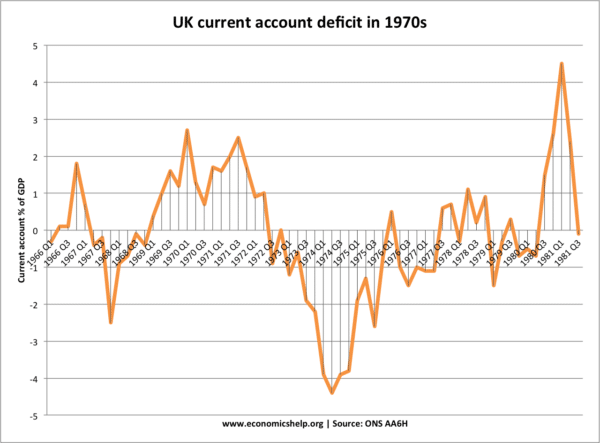

If unions become too powerful they can bargain for higher wages above the rate of inflation. If this occurs it may contribute to wage-inflation. Powerful trades unions were a significant cause of the UK's inflation rate of 25% in 1975.

Evaluation

The benefits of trades unions depend on their circumstances. If they face a monopsony employer they can help counterbalance the employers market power. In this case, they can increase wages without causing unemployment. If unions become too powerful and they force wages to be too high, then they may cause unemployment and inflation

It also depends very much on the nature of the relationship between trade unions and employers. If relations are good and constructive, the union can be a partner with the firm in maintaining a successful business, which helps protect jobs and higher wages. However, if the relationship between trade unions and the management become confrontational, it can escalate into destructive partnerships which cause a decline in profitability and puts the long-term security of jobs at risk

Related