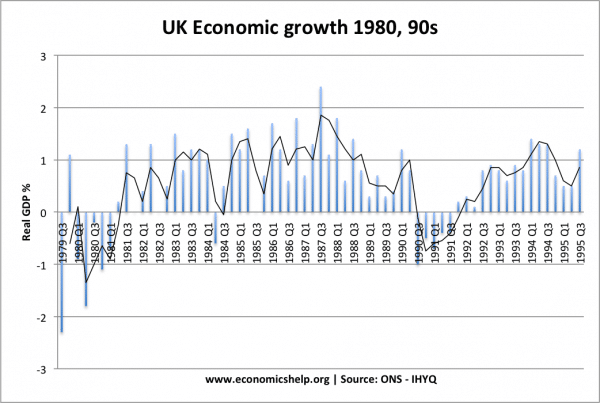

Between 1985 - 1988, UK economic growth was well above the long run trend rate of 2.5%. By 1990, inflation had increased to 9.5%.

Between 1985 - 1988, UK economic growth was well above the long run trend rate of 2.5%. By 1990, inflation had increased to 9.5%.- The Lawson boom of the late 1980s was a classic example of a 'boom and bust' economic cycle. The late 1980s were a period of rapid economic expansion. This was caused by rising house prices, tax cuts, lower interest rates and high confidence.

- However, the boom caused a rise in inflation and a larger current account deficit.

- Policies to tackle this inflation caused the recession of 1991-92.

Economic growth in the 1980s

Causes of the Lawson Boom

Tax CutsIn 1988, the chancellor Nigel Lawson reduced the basic rate of income tax from 29% to 25%. The higher rate of income tax was cut to 40%. The 1988 budget is often referred to as the 'giveaway budget'. The chancellor was helped by good revenues from North Sea oil.

The effect of these tax cuts was a fiscal stimulus which helped to increase disposable income and consumer confidence. This led to a rise in consumer spending and economic growth.

Over optimism

During the 1980s, the government felt that they had presided over an 'economic miracle'. They felt that the last recession had removed a lot of inefficient firms. They also felt that supply-side policies, such as privatisation, had been effective in increasing the productivity of the economy and therefore had increased the long run trend rate of growth. This belief encouraged the chancellor to believe the economy could grow at a much faster rate than previously. Therefore, when growth increased above 4%, they did little to slow down an overheating economy. They believed (or hoped) that the long run trend rate of economic growth had increased from 2.5% to 4%. As Nigel Lawson said in his budget speech 1988.

"In 1987 as a whole, output grew by getting on for 4½ per cent., rather more than the rate of inflation which averaged 4.2 per cent. At the same time, unemployment fell faster than in any other year since the war, in every region of the country, and more than in any other major nation.However, this was not the case and economic growth of 4%, led to a growing current account deficit and rising inflation rate.

The plain fact is that the British economy has been transformed. Prudent financial policies have given business and industry the confidence to expand, while supply side reforms have progressively removed the barriers to enterprise." (source)

2. A reluctance to increase interest rates

In the 1980s, interest rates were set by the Chancellor (not the independent Bank of England, like now) In October 1987, there was a stock market crash. In one week 25% of the stock market value was wiped out. There was no obvious economic cause of this, but the government was worried about its macroeconomic implications. As a result interest rates were reduced, to avoid any downturn. As it happened the stock market crash had only a marginal macro-economic effect and the economy continued to grow at a rapid rate. But, the impact of that cut in interest rates in 1987 was to encourage the boom - and in particular the housing boom.

In the 1980s, interest rates were set by the Chancellor (not the independent Bank of England, like now) In October 1987, there was a stock market crash. In one week 25% of the stock market value was wiped out. There was no obvious economic cause of this, but the government was worried about its macroeconomic implications. As a result interest rates were reduced, to avoid any downturn. As it happened the stock market crash had only a marginal macro-economic effect and the economy continued to grow at a rapid rate. But, the impact of that cut in interest rates in 1987 was to encourage the boom - and in particular the housing boom.3. Exchange Rate Mechanism ERM

The ERM was another factor keeping interest rates lower than they should. Mrs Thatcher didn't want to join the ERM. However, the Chancellor Nigel Lawson wanted to follow an unofficial exchange rate of 3 DM to £1. This often proved to be a factor in preventing interest rates from rising. The Chancellor didn't want to increase interest rates because it would break the 'unofficial exchange rate.low interest'

4. The housing boom

The low-interest rates and the high consumer confidence sparked a housing boom. During the boom years, house prices rose by 300% (and more in places like London). Q4 1988 was the peak of the boom period with house prices rising over 30% at an annual rate. This boom in house prices caused a rise in household wealth and increased confidence. Equity withdrawal rose to record levels, which helped increase consumer spending.

Rising interest rates meant mortgage payments in the late 1980s took over 50% of disposable income.

By 1988 and 1989, the economy was growing at 5% a year (almost double the long run trend rate) Despite signs of overheating, the government were reluctant to react. Interest rates were increased, but not as quickly as they could have. Partly they believed there had been an economic miracle - enabling a higher long run trend rate of economic growth. But, also Nigel Lawson, didn't want higher interest rates to boost the value of the Pound above the 'unofficial exchange rate' he was following. This was a policy known as shadowing the D-Mark. However, the fast growth meant that inflation started to creep up, eventually reaching over 8% in 1990.

With inflation at 8%, interest rates were increased further, but this caused mortgage payments to increase and the confidence evaporated as many people found they couldn't afford the mortgage repayments.

Current account deficit

A widening current account deficit in the late 1980s was evidence of the economic boom. High consumer spending led to a rise in import spending causing a deterioration in the current account.

Higher growth led to a bigger current account deficit. In 1989, the current account was 4.9% of GDP - reflecting the fact the economy was overheating and consumers were buying from abroad; domestic suppliers could not meet the rising demand.

Higher growth led to a bigger current account deficit. In 1989, the current account was 4.9% of GDP - reflecting the fact the economy was overheating and consumers were buying from abroad; domestic suppliers could not meet the rising demand.Unemployment in the 1980s

UK unemployment fell during the Lawson Boom(1985-89) But rose as interest rates were increased in 1990.

Conclusion

The 1980s was a missed opportunity and the recession of 1991 unnecessary. By the mid 1980s, the government had reduced inflation - through a deep recession. There had also been some supply side reforms which helped aspects of the economy. Privatisation and reform of trades unions did help increase productivity and efficiency. However, these improvements were nothing like enough to enable a 'supply side miracle'. The main lesson of the Lawson boom was that the government made a big mistake in allowing the economy grow too fast, leading to inflation and an unsustainable boom. The consequence of this boom, was a painful recession as belatedly the government tried to bring inflation down again.

Other notes on this period.

- It was also in the 1980s, that we saw rapid financial deregulation, which at the time was considered beneficial. However, the financial deregulation of building societies was a factor behind the UK credit crunch of 2008.

- The Lawson Boom also saw a period of widening inequality - helped by cuts to tax rates for high earners.

- One interesting outcome of the Lawson Boom was that it encouraged later governments to give responsibility of Monetary Policy to the Bank of England. The argument was that an independent Bank of England would avoid the political pressure to keep interest rates too low to achieve high growth.

5 comments:

Everyone has a personal view, good commentators present a balanced view. It is noteworthy that you split Thatcher's rule into two parts, "The UK Economy under Thatcher from 79 - 84" which you dismiss as a recession, and "The Lawson Boom of the late 1980s", equally pejorative. I assume you did not vote for Mrs Thatcher? Whilst the data in your articles is true, you should also mention the positive effects of all her reforms, including:

- Dismantling of Unions that had crippled UK

- "small government" ethos(compare to today!)

- low taxation (top rates of 99% during 1970's)

- vastly improved workplace legislation (now taken away by Brussels)resulting in much inward investment (in marked comparison to much of Europe, still badly in need of reform)

- Euroscepticism, and prophetic warnings on the insanity of Euro

- All the above encouraging businesses

UK was a mess when Thatcher took over. No economy is ever perfect, and all leaders including her leave a mess, but the mess she left was substantially better than the mess she inherited

Had you avoided personal opinion tainting your points dressed up as 'fact' then your contribution may have gained respect.

Adrian Rayner - how much of the 1980's economic growth and prosperity under Mrs Thatcher and Mr Lawson was due to North Sea Oil ? The UK's balance of Payments and government tax revenues benefited greatly from North Sea Oil in the 1980's - would the picture have been so rosy as you paint in the absence of these ?

Mrs Thatcher also benefited greatly from the longest global bull market run the stockmarket has even seen. It allowed her a latitude of action no other Prime Minister has ever had. Now that was pure luck, but she saw the opportunity and took it. In fact she had a lot of luck. What if we had lost the Falklands War ? Its ironic that the very institutions she was committed to cutting saved her reputation !

It would be nice for some people to admit that she was not a deity and had serious failings from time to time. Her legacy is that she changed the political and economic agenda.In some ways that was a good thing and in other ways I'm not so sure. She did rather sell us off, something that the Germans have never allowed in their key industries. Who has done the better over the last 40 years? The Germans of course.

The ability to buy council houses was a a way to create a society that had pride in their accomodation, and hence look after it themselves unburdening the councils from an inefficient repair workforce. She never forsaw that so many of the greedy owners would remortgage up to the hilt to finance their exorbitant lifestyles.

Post a Comment