- Loss of income

- Firms going bankrupt.

- Psychological and health problems of the unemployed

- Higher government borrowing (lower tax receipts and higher benefit spending)

- Is there just a sweeping away of inefficient firms enabling a rebounding of economic growth and higher productivity? - or

- Is there a permanent loss of output and a persistent loss of economic welfare, even when the recession is officially over?

Long Term Effects of Recessions

Levels of Education. Studies in US, show that prolonged periods of unemployment lead to some students being unable to afford college education. It can also lead to lower levels of education amongst under 7s. If recession does effect levels of education then there will be a corresponding long-term effect on earnings of those affected. It will also lead to higher long-term inequality. Those without access to education will typically face lower income levels in later life.- However, in the UK, student numbers have increased during the recession as students seek to avoid a difficult job market and go to university instead.. One factor is that education is more expensive in the US, therefore recession and lower income in the US leads to lower demand. However, as fees in the UK rise, recession may increasingly deter education.

Private Investment

Recessions have a significant deterrent effect on private investment. Investment has been particularly badly affected in the 2008-12 downturn because of limited access to bank credit. If the recession is prolonged, this can have a long-term impact on levels of capital and productive capacity.

Lost Output

In some short-lived recessions, output has often bounced back and caught up with the lost output. This has enabled the economy to keep the long-run trend rate of growth. For example, in 1994, the UK economy grew by nearly 4% which helped catch up 'lost output' of the 1991-92 recession, and maintain a long-run trend rate of 2.5%.

Bounce after recession of 1981 and 1991.

However, with a longer 'balance sheet recession', there is evidence that output has been permanently lost. This balance sheet recession has not just been a temporary fall in demand due to higher interest rates. It has involved a credit crunch, lower bank lending, and falling asset prices. It has lasted much longer and caused a much more prolonged fall in GDP.

Europe's Lost Output

source: Europe's Gap

US Output and Potential Output

Even the most optimistic forecasts for recovery suggest slow growth. There is going to be no bounce to catch up with lost output. The longer the recession lasts, the greater the risk that output will fall below the trend of potential output.

Business

Recessions make it more difficult for new firms to start. There are examples of firms who have been able to start in the middle of a recession (Microsoft 1975), CNN (1980) Disney (1923). But, in recession, typically business-starts fall dramatically. Also existing firms are at risk of bankruptcy. In 2008 in the US, 43,500 businesses filed for bankruptcy, up from 28,300 businesses in 2007. Some argue that a recession 'weeds out' inefficient firms. But, even good, efficient firms can go out of business due to temporary liquidity problems.

It is possible, some firms merely delay start-up, but for some firms, a few years may mean the window of opportunity passes and two years later is too late.

Impact on Government Borrowing

This permanently lost output also means permanently lost tax revenues. In this current recession, many economies have felt the need to reduce government spending as a result of the cyclical increase in their budget deficit (especially countries in the Eurozone). However, this cut in government spending has adversely affected capital investment and the rate of economic growth. It is part of the reason why the recession has been difficult to overcome. Therefore, if recessions cause an unsustainable rise in government borrowing, it may cause governments (rightly or wrongly) to cut spending and increase taxes which further damages economic growth in both the short term and long-term.

Inequality

The biggest cause of inequality and relative poverty is unemployment. A rise in in unemployment leads to lower income and can harm nutritional intake and quality of life. In the US, there are also impacts upon health care, with unemployment causing a fall in health care insurance. Poorer health care and nutritional levels can impact in the long-term.

Impact on Younger Generation

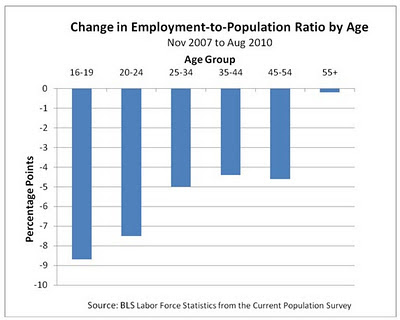

Effects of recession on younger workers. source

In the long term, this will impact young peoples future earning potential. It is hard to recovery from a period of unemployment in early working life. It leaves a gap in your CV and damages future employment and promotion prospects.

In addition, highly concentrated youth unemployment can lead to a rise in social problems. Higher unemployment rates can lead to higher rates of crime, vandalism and social dissatisfaction. This feeling of social exclusion can be difficult to eradicate when the economy gets out of recession.

- A culture of unemployment amongst young people definitely has long-term effects.

No comments:

Post a Comment