Commerical banks charge a higher interest rate on loans and pay a lower rate on savings. This difference between the cost of borrowing and rate of return on savings is part of the reason banks are profitable. Lending customers deposits at a higher rate than they pay customers interest on their savings.

Types of interest rates

Interest rates are controlled by the Central Bank (sometimes governments set interest rates directly). The Central Bank change a base rate. This base rate is the rate they charge to commercial banks. If the base rate rises, commercial banks will tend to put up their standard variable rates.

Effect of an Increase in Interest Rates

If interest rates go up, we will see:

- Cost of borrowing is more expensive. If borrowing is more expensive consumers will take out fewer loans. Firms will borrow less. Therefore consumer spending and investment will fall (or increase at slower rates)

- Mortgage and loan repayments increase. This reduces consumer disposable income and consumer spending further.

- Return on savings increase. More attractive to save and this will reduce consumer spending

- Higher interest rates cause an appreciation in the exchange rate due to hot money flows. (It is more attractive to save in the UK, if UK interest rates are higher than other countries)

- An appreciation in the exchange rate makes more expensive, leading to less export demand

- Fall in asset prices. Higher interest rates can make it less attractive to buy a house with a mortgage leading to lower house prices.

Macro effects

- If consumer spending and investment falls, this will lead to lower AD. Therefore this causes a fall in Real GDP or at least a fall in the rate of economic growth.

- Lower growth will tend to increase unemployment. With less output, firms demand less workers.

- Lower growth will also help to reduce inflation.

Evaluation of Interest rate increases

1. Depends on the situation of the economy

If the economy is at full capacity a rise in interest rates may reduce inflation, but not growth. However, if there is already spare capacity then rising interest rates could cause a recession.

2. Depends on other components of AD

For example, if exports are rising, or if consumers confidence is high; rising interest rates may not reduce AD. For example, in the late 1980s, there were modest rises in interest rates, but the other aspects of the economy were growing so quickly, it failed to halt the above trend rate of growth (until 1991/92 when interest rates reached a record 15%)

3. Income effect of higher interest rates

Higher return on saving may give some consumers a high income. This will be consumers like pensioners. However, in the UK, the savings ratio is quite high, therefore the income effect of a rise in interest rates is likely to be quite low. The substitution effect will be higher.

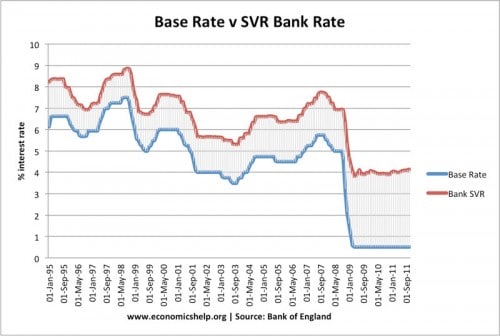

4. It depends whether commercial banks pass interest rate cut onto consumers. In the credit crunch, banks didn't reduce their Standard Variable Rate as much as the Bank of England cut its base rate.

In Credit Crunch of 2008, lower interest rates failed to boost economic growth.

How does Bank of England decide whether to increase interest rates?

The Bank will look at a wide variety of statistics to consider the state of the economy. The most important factors are

- Inflation target of 2%. But Bank has to consider other objectives such as

- economic growth and inflation.

- It also has to consider the type of inflation. Is it temporary cost-push inflation or underlying inflationary pressures.

- Is the economy reaching full capacity?

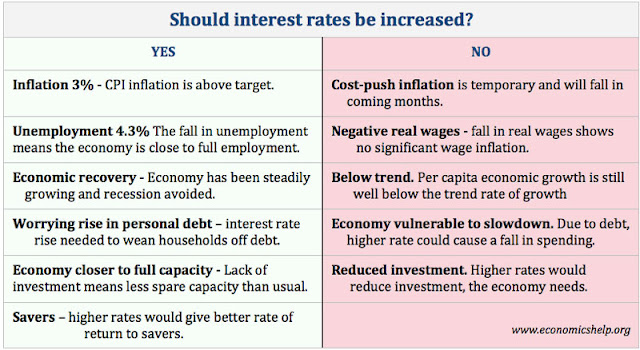

Example of interest rate dilemma Nov 2017

Should interest rates go up?

Real interest rates

Real interest rate = nominal interest rate - inflation rate.

If interest rates are 5%, and inflation is 3%, the real interest rate is 2% - savers will see a positive return on savings.

However, if interest rates stay at 5% and inflation rises to 6%, then real interest rates become negative. Real interest rates will be -1.0%

See also:

No comments:

Post a Comment