There are several reasons why deflation is considered to be harmful to the economy.

- Discourage buying. When general prices are falling, consumers tend to delay purchasing. For example, rather than buy a flatscreen today, they wait a year when they will be cheaper. The effect of falling prices is to depress consumer spending leading to lower economic growth.

- Increasing real value of debt. When people take on debt like mortgages, they expect the value of the debt to be steadily eroded by inflation. (A mortgage becomes easier to repay as your wage increases). When there is deflation, the real value of debts increases. You owe the same, but, your wage is falling. Therefore, you have to spend a higher % of your income on servicing the deb.

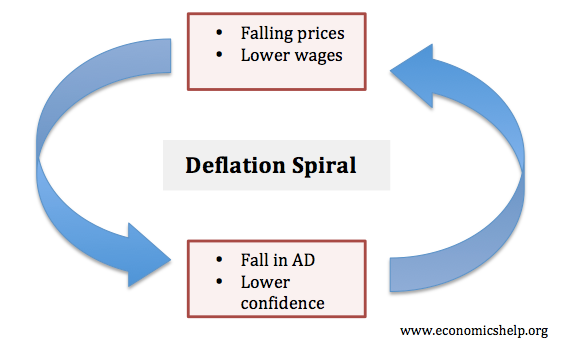

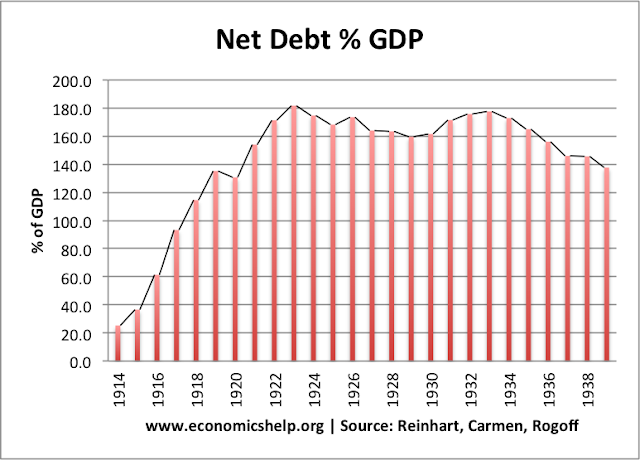

The increasing real value of debt can cause a deflationary spiral. As prices fall and debt increases, it leads to lower confidence, lower spending (lower AD) and this leads to a further fall in prices and wages. - Increasing Government Debt to GDP ratio. Deflation also increases the real value of government debt. It makes it much more difficult to reduce the debt to GDP ratio. Thus countries can start spending a higher % of income on debt repayment. Furthermore, as deflation tend to reduce economic growth, the cyclical deficit increases. The lack of growth of nominal GDP was a key factor behind the increase in debt to GDP in Greece, during the debt crisis of 2010s. In the UK in the 1920, deflation kept debt to GDP above 100% of GDP for two decades.

- Real Wage Unemployment. In deflation, wages may need to fall so firms can afford to keep employing workers. However, wages are often sticky downwards. (Unions resist nominal wage cuts). Therefore, falling prices are often not met by falling wages this leads to a rise in real wages. This creates real wage unemployment. It also makes a countries exports less competitive (particularly a problem in the Eurozone where countries can't devalue the exchange rate)

Demand for labour falls to D2 causing equilibrium wage to fall to W2. But, if wages are sticky downwards they remain at W1 causing unemployment of Q3-Q1. - Monetary Policy Becomes ineffective. With deflation, zero interest rates may be too high. Even quantitative easing may be insufficient to get people spending. (deflation and monetary policy) The problem is that it is difficult to cut interest rates below zero and so the monetary authorities cannot adequately deal with the slow growth and deflation.

No comments:

Post a Comment