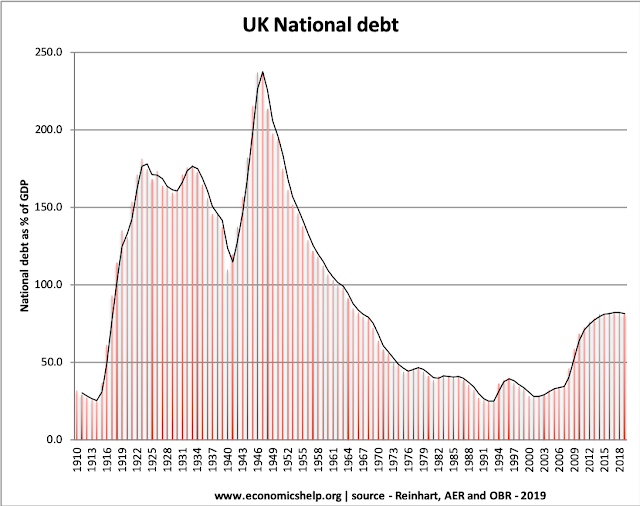

- Historical precedents. In WWII, the OBR said the UK ran a budget deficit of nearly 27% of GDP. By the early 1950s, UK national debt had risen to 240% of GDP. Yet this was not a significant problem. In the post-war period, the UK enjoyed a long period of economic expansion, where debt to GDP ratios fell. In March 2020, UK debt to GDP ratio was around 80% of GDP, so there is significant room for an increase in government debt.

- Government's have the ability to create money. Some economists (especially those believing in MMT) argue the only constraint to government borrowing is inflation. In other words, higher government spending financed by printing money is only a problem when it causes inflation. In a severely depressed economy, with inflation falling (and possibly deflation) it maybe desirable for the government to create money and target a positive inflation rate. In 2009/10 recession, US and UK financed some borrowing through quantitative easing.

- In a recession, most economists accept that a rise in government borrowing is necessary to offset the fall in private sector investment and spending. Keynesian economics says expansionary fiscal policy can help an economy recover. But austerity (cutting spending) can make the recession worse, worsening tax revenues and be counter-productive in cutting borrowing.

- During a period of economic growth when the economy is close to full capacity, government borrowing can cause many problems such as crowding out of the private sector, pushing up interest rates, and possible inflationary pressures.

- Does it print its own currency?

- Do markets trust the government to maintain low inflation and not default?

- What are the interest rate on government bonds?

- What is the state of the economy?

- What is the purpose of government borrowing?

- To what extent is the government borrowing from domestic or foreign investors?

Levels of government debt

At times government debt has been very high:- US 117% of GDP in 1945 (gross federal debt (1)

- UK 240% of GDP in the early 1950s

- Japan has national debt over 230% GDP

How does the government finance its debt?

- Selling government bonds to the private sector - either domestic or foreign. The private sector buy bonds because the security and interest rate on them.

- The Central Bank can finance shortfall in revenue by increasing the money supply and buying bonds itself. This is sometimes known as quantitative easing.

Factors which influence how much a government can borrow

- Domestic savings. If consumers have a high savings ratio, there will be a greater ability for the private sector to buy bonds. Japan has very high levels of public sector debt, but with high domestic savings, there has been a willingness by the private sector to buy the government debt. Similarly, during the Second World War, the government was able to tap into the high levels of domestic savings to finance UK debt.

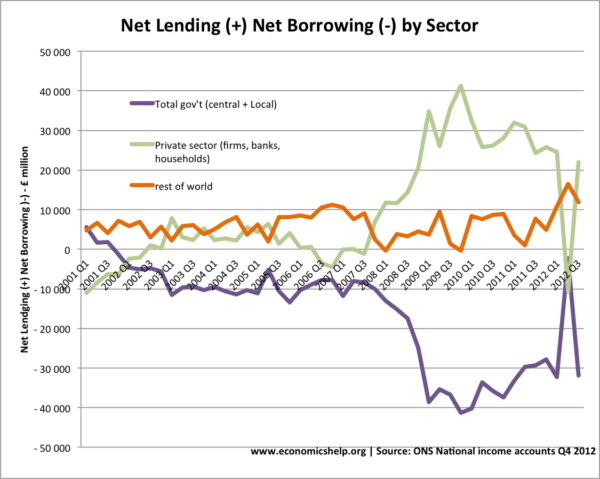

This shows that the rise in government borrowing in 2009/10 recession mirrored the rise in private sector savings.

- In a depression, we tend to see a rise in private sector saving (the paradox of thrift) because households fear being made unemployed and firms don't want to invest. Therefore, in a recession, there is often surplus private sector savings. A surplus of unused savings means there is an advantage for the government to borrow, invest, create jobs and make use of these surplus savings. As Greg Mankiw said in March 2020. "There are times to worry about the growing government debt. This is not one of them."

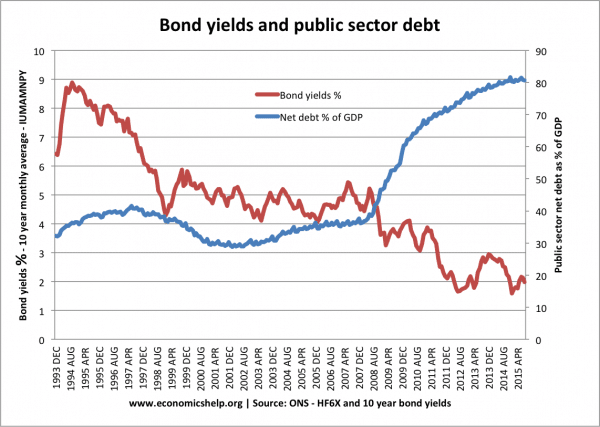

- Relative interest rates. If government bonds pay a relatively high-interest rate compared to other investments, then ceteris paribus, it should be easier for the government to borrow. Sometimes, the government can borrow large amounts, even with low-interest rates because government bonds are seen as more attractive than other investments. (e.g. in a recession government bonds are often preferred to buying shares (which are more vulnerable in a recession). This is why US bond yields fell 2008-11, despite growth in US government borrowing.

This

shows that during a period of higher government borrowing 36% of GDP

increasing to 80% of GDP - bond yields fell from 9% to 2%

- Lender of last resort. If a country has a Central Bank willing to buy bonds in case of liquidity shortages, investors are less likely to fear a liquidity shortage. If there is no lender of last resort (e.g. in the Euro during 2011/12) then markets have a greater fear of liquidity shortages and so are more reluctant to buy bonds.

- Confidence and security. Usually, governments are seen as a safe investment. Many governments have never defaulted on debt payments so people are willing to buy bonds because at least they are safe. However, if investors feel a government is too stretched and could default, then it will be more difficult to borrow. Therefore, some countries like Argentina with bad credit histories would find it more difficult to borrow more. Political uncertainty can make investors more concerned.

- Foreign Purchase. A country like the US attracts substantial foreign buyers for its debt (Japan, China, UK). This foreign demand makes it easier for the government to borrow. However, if investors feared a country could experience inflation and a rapid devaluation, foreigners would not want to hold securities in that country and it could lead to capital withdrawal.

- Inflation. Financing the debt by increasing the money supply is risky because of the inflationary effect. Inflation reduces the real value of the government debt, but, that means people will be less willing to hold government bonds. Inflation will require higher interest rates to attract people to keep bonds. In theory, the government can print money to reduce the real value of debt; but existing savers will lose out. If the government creates inflation, it will be more difficult to attract savings in the future. A crucial factor is whether inflation is likely. In a recession, inflationary pressures vanish so it is much easier to finance a deficit by borrowing.

Why did Eurozone countries experience more debt problems than UK and US in 2012?

Bond yields in Italy, increased despite Italy having a primary budget surplus. This was a similar story for other countries in the Euro. One issue is that (between 2011 and 2013) Italy had no Central bank willing to act as a lender of last resort. See more reasons for Italian Debt Crisis

However, when the ECB agreed to effectively intervene in the bond market, bond yields fell.

Related

5 comments:

Hi

How far can the pound fall before the government has to protect its citizens from the effects of a worthless currency? Surely joining the € and effectively fixing the exchange forever seem to make more sense now than ever before. The argument about interest rates do not, seem as valid as before, now we know the banks have their own inter bank rates, also the “toilet paper currency as the Tories once described the € seem to have back fired. Which is the toilet paper currency now? This debate will not go away Britain is coming to the cross roads, and as I see it what point is there in being part of Europe if its citizens can not afford even to holiday there? That alone do business which is not on an even playing field?

Regards

Clive Cargill

Hi

How far can the pound fall before the government has to protect its citizens from the effects of a worthless currency? Surely joining the € and effectively fixing the exchange forever seem to make more sense now than ever before. The argument about interest rates do not, seem as valid as before, now we know the banks have their own inter bank rates, also the “toilet paper currency as the Tories once described the € seem to have back fired. Which is the toilet paper currency now? This debate will not go away Britain is coming to the cross roads, and as I see it what point is there in being part of Europe if its citizens can not afford even to holiday there? That alone do business which is not on an even playing field?

Regards

Clive Cargill

Both the above article and Mr Blanchard of the IMF make the totally false assumption that stimulus necessarily involves extra debt.

As Keynes, Milton Friedman and a string of other Nobel prize winning economists have periodically pointed out over the last 80 years (e.g. William Vickrey), STIMULUS DOES NOT NECESSITATE EXTRA DEBT.

Re Friedman, see ; http://nb.vse.cz/~BARTONP/mae911/friedman.pdf

Re Keyes see: http://www.scribd.com/doc/33886843/Keynes-NYT-Dec-31-1933 and search for the passage starting “Individuals must be induced….”

For advocates of Modern Monetary Theory (Google it), the idea that stimulus requires extra debt is just a sick joke. If Economics Blog wants to get with it, I suggest it gets to grips with Modern Monetary Theory (also known as Functional Finance).

What none of these figures take any account of is the debt associated with more than three million permanent immigrants to the UK since 1997 and access to the welfare state. The NHS, education sector and housing sector have been drained of billions of pounds of resources not accounted for in aNY GOVERNMENT STATISTICS which make the rest of the statistics presented here meaningless.

ALL money is created as debt and destroyed when repaid.97% of the money we use is Private(digital)Bank loan money.Checkout positivemoney.org [the UK monetary reform group]for detail.

Post a Comment