- The paradox of thrift is a concept that if many individuals decide to increase their private saving rates, it can lead to a fall in general consumption and lower output.

- Therefore, although it might make sense for an individual to save more, a rapid rise in national private savings can harm economic activity and be damaging to the overall economy.

- In a recession, we often see this 'paradox of thrift'. Faced with the prospect of recession and unemployment, people take the reasonable step to increase their personal saving and cut back on spending. However, this fall in consumer spending leads to a decrease in aggregate demand and therefore lower economic growth.

Paradox of thrift during 2020 corona recession

- In 2020, the economic shutdown will lead to an unprecedented rise in savings. Partly because people are very nervous about the future economy but also because opportunities to spend are severely limited.

- On the other hand, people who see a large fall in income will have to dip into their savings and borrow to stay afloat.

Paradox of thrift during 2009 Recession

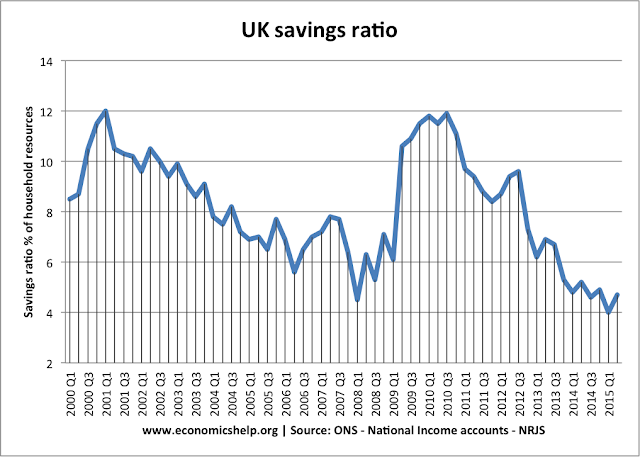

In the recession of 2008, we see a sharp rise in the UK saving ratio as consumers respond to bad economic news by increasing saving and cutting back on spending.

This fall in spending and a rise in saving contributed to the recession.

Paradox of Thrift in 1930s

In the great depression of the 1930s, GDP fell, unemployment rose and the UK experienced a long period of deflation. In response to this disastrous economic situation, mainstream economists were at a loss as how to respond. Such a lengthy period of disequilibrium didn’t sit well with Classical theory which expected markets to operate smoothly and efficiently.One policy the National government did approve was the cutting of unemployment benefits. The rationale was that in times of depression the govt should set an example by reducing its debt. This example actually inspired members of the public to send in their savings in the hope that it would help the economy.

By reducing benefits they further reduced consumer spending and AD. This made areas of high unemployment even more impoverished. When people saved rather than spent their money it just made the recession worse.

Keynes and paradox of thrift

In the 1930s, J.M. Keynes argued that this 'paradox of thrift' was pushing the economy into a prolonged recession. He argued that in response to higher private saving, the government should borrow from the private sector and inject money into the economy.This government borrowing wouldn't cause crowding out because the private sector were not investing, but just saving.

In the UK and US Keynes was largely ignored until after the war and as a consequence the UK economy experienced high levels of unemployment for the remainder of the decade.

Who coined the term paradox of thrift?

Keynes first popularised the term as it fitted in neatly with his concept that recessions were caused by falls in aggregate demand. It also justified higher government borrowing to offset the private sector savings. He mentioned it in his General Theory."For although the amount of his own saving is unlikely to have any significant influence on his own income, the reactions of the amount of his consumption on the incomes of others makes it impossible for all individuals simultaneously to save any given sums. Every such attempt to save more by reducing consumption will so affect incomes that the attempt necessarily defeats itself. It is, of course, just as impossible for the community as a whole to save less than the amount of current investment, since the attempt to do so will necessarily raise incomes to a level at which the sums which individuals choose to save add up to a figure exactly equal to the amount of investment.This rather long-winded statement was shortened by Paul Samuelson, who used the term 'paradox of thrift' in his influential post-war macroeconomics text book.

— John Maynard Keynes, The General Theory of Employment, Interest and Money, Chapter 7, p. 84

The idea was also in use before Keynes. In 1893, in the The Fallacy of Saving, John M. Robertson writes on the potential problem of many individuals saving at once.

"Had the whole population been alike bent on saving, the total saved would positively have been much less, inasmuch as (other tendencies remaining the same) industrial paralysis would have been reached sooner or oftener, profits would be less, interest much lower, and earnings smaller and more precarious. This ... is no idle paradox, but the strictest economic truth."

— John M. Robertson, The Fallacy of Saving, pp. 131–132

Paradox of thrift and government borrowing

The paradox of thrift suggests that if there is a recession, there will be a rise in private sector saving and hence greater demand to buy government bonds. Therefore, even if the government borrow more, bond yields may fall.Criticisms of paradox of thrift

- Higher saving increases bank balances and can lead to an increase in bank lending - and hence investment.

- A fall in demand from higher saving, will cause lower prices, which encourage demand to increase. This is related to Say's Law which states supply creates its own demand.

- Higher domestic savings can lead to lower domestic inflation and therefore increase exports. Higher exports can boost demand.

Responding to criticisms

- In a recession, banks may not want to lend, and even if banks do want to lend, firms do not want to borrow and invest. In fact, in a recession, firms may do the same as consumers and try to save more and pay back dent.

- Prices may be sticky downwards and not fall, even if there is lower demand. Also, if prices fall, deflation can discourage spending because real value of debt rises.

- Not every country can 'export' its way out of a recession.

Related

9 comments:

I do not agree that this is the paradox of thrift. To me, thrift is where state spending falls, and private sector spending rises to accomadate this fall? Please correct me if I am wrong.

Here the thrift is when the private sector decide to save more - causing a fall in Aggregate Demand.

Harry, this is indeed the paradox of thrift. The paradox lies in the fact that while saving (being thrifty) is undoubtedly beneficial for individuals - when a large group of individuals all act the same way, this however turns out to be detrimental to the economy as a whole and all individuals involved.

And this is what is happening now. In The Netherlands, savings increased by €6 billion in 2012 while consumer spending fell. The fall in spending leads to a fall in overall demand. Families are delaying purchases and looking out for their own well-geing because of the recession but the aggregate effect is severe harm to the overall economy.

I honestly dont understand the paradox of thrift.......is it contrastin

i think paradox of thrift means saving of an individual ultimately decrease the saving. it is because of when an individual save his/her money then this money is hoarding and doesnot create any employment and investment which decreases the future earning of a person and ultimately saving itself.

i think paradox of thrift means saving of an individual ultimately decrease the saving. it is because of when an individual save his/her money then this money is hoarding and doesnot create any employment and investment which decreases the future earning of a person and ultimately saving itself.

Can I ask a question and anybody is free to answer this... Does Keynes' Paradox of Thrift present difficulties for the neoclassical understanding of optimization?

So some how we could say....it is same liek liquidity trap...where people hold money with themselves and don't invest causing to fall in AD and eventually leading to involuntary unemployment 🤔 ?

Post a Comment